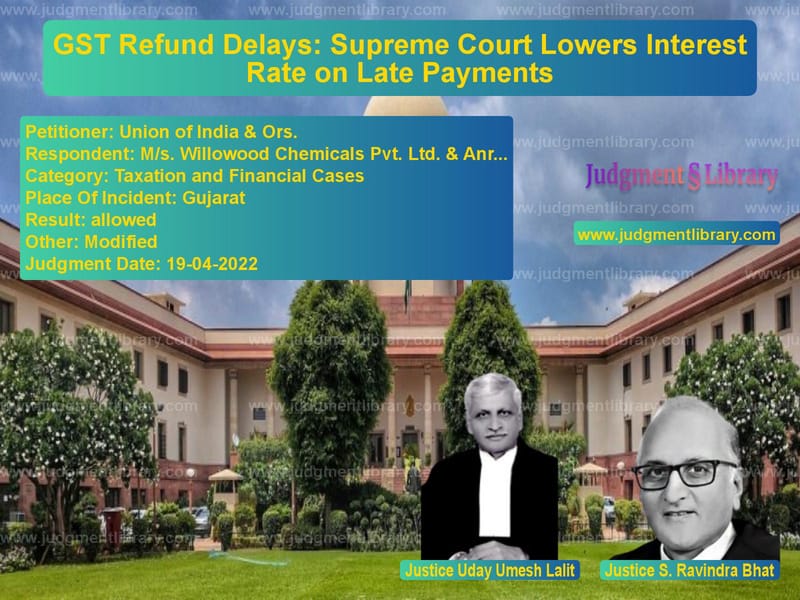

GST Refund Delays: Supreme Court Lowers Interest Rate on Late Payments

The case of Union of India & Ors. vs. M/s. Willowood Chemicals Pvt. Ltd. & Anr. and Union of India & Ors. vs. M/s. Saraf Natural Stone & Anr. concerns delayed GST refunds for exporters and the applicable interest rate for such delays. The Supreme Court ruled on the legality of awarding interest at 9% per annum on delayed refunds and ultimately reduced it to 6% in line with statutory provisions.

Background of the Case

The appeals stem from two separate cases involving refund delays under the Integrated Goods and Services Tax (IGST) Act, 2017. The respondents—M/s. Willowood Chemicals Pvt. Ltd. and M/s. Saraf Natural Stone—had applied for GST refunds related to exports. However, these refunds were delayed by periods ranging from 94 to 290 days.

Key Facts

- Both companies were eligible for a refund of integrated tax paid on exports under Section 16 of the IGST Act.

- Their claims were governed by Section 54 of the Central Goods and Services Tax (CGST) Act.

- Refunds were granted after prolonged delays, impacting their financial liquidity.

- The Gujarat High Court ruled that the government was liable to pay interest at 9% per annum for the delay.

- The Union of India challenged this decision, arguing that interest should be capped at 6% per annum, as specified in Section 56 of the CGST Act.

Legal Framework for GST Refunds

The provisions governing refunds and interest on delayed payments are found in the CGST Act and IGST Act:

- Section 16 of the IGST Act: Allows exporters to claim refunds on input tax credit or integrated tax paid on exports.

- Section 54 of the CGST Act: Governs refund applications and processing timelines.

- Section 56 of the CGST Act: Specifies an interest rate of 6% per annum on delayed refunds, with a 9% rate applicable only in cases where refunds are delayed due to a final adjudicated order.

Arguments of the Petitioners (Union of India)

- The government admitted liability for interest payments but argued that the statutory rate of 6% should apply, not 9%.

- They contended that the Gujarat High Court incorrectly applied the higher 9% rate, which is meant for cases where a refund is delayed due to an order from an adjudicating authority.

- The government had already paid interest at 6% and sought to overturn the additional 3% interest imposed by the High Court.

Arguments of the Respondents (Exporters)

- The exporters argued that the excessive delay in refunds had caused severe financial strain, affecting their business operations.

- They emphasized that the delay was arbitrary and unjustified, warranting a higher interest rate as compensation.

- They relied on precedents like Sandvik Asia Ltd. vs. Commissioner of Income Tax and K.T. Plantation Pvt. Ltd. vs. State of Karnataka, where higher interest rates were awarded for undue delays.

Supreme Court’s Ruling

The Supreme Court, comprising Justices Uday Umesh Lalit and S. Ravindra Bhat, ruled in favor of the government, setting the interest rate at 6% per annum. The Court made the following key observations:

1. Interest Should Be Governed by Statutory Provisions

The Court emphasized that interest on delayed refunds must adhere to statutory provisions. It stated:

“Wherever a statute specifies or regulates the interest, the interest will be payable in terms of the provisions of the statute.”

2. Higher Interest Only in Adjudicated Cases

The Court clarified that the 9% interest rate applies only when a refund delay arises due to an order from an adjudicating authority or appellate tribunal. Since this was not the case here, the higher rate was deemed inapplicable.

3. Sandvik Asia Case Not Applicable

The respondents relied on the Sandvik Asia case, where a 9% interest rate was granted for extreme delays. However, the Court distinguished this case, noting that Sandvik Asia involved delays of over 17 years, whereas the present case involved delays of less than a year.

4. Equity Considerations Do Not Override Legal Provisions

The Court rejected arguments based on equity, reiterating that statutory interest rates must be followed:

“Interest cannot be awarded based on equitable grounds when the statute clearly prescribes a specific rate.”

Final Judgment

- The Supreme Court allowed the appeal and set the interest rate at 6% per annum.

- Since the government had already paid interest at 6%, no further payments were required.

- The ruling reaffirmed the importance of following statutory provisions in tax matters.

Impact of the Judgment

This ruling has significant implications for businesses and the tax administration:

- Ensures clarity on interest rates applicable to delayed GST refunds.

- Limits the ability of courts to deviate from statutory interest rates based on equity.

- Reaffirms that higher interest rates are applicable only in cases involving adjudicated refunds.

- Encourages faster refund processing to reduce litigation on interest disputes.

Conclusion

The Supreme Court’s decision in Union of India vs. Willowood Chemicals Pvt. Ltd. and Union of India vs. Saraf Natural Stone reinforces the principle that tax laws must be followed as written. While delays in tax refunds remain a concern for businesses, this ruling establishes a clear precedent on the interest rate applicable to such delays.

Petitioner Name: Union of India & Ors..Respondent Name: M/s. Willowood Chemicals Pvt. Ltd. & Anr., M/s. Saraf Natural Stone & Anr..Judgment By: Justice Uday Umesh Lalit, Justice S. Ravindra Bhat.Place Of Incident: Gujarat.Judgment Date: 19-04-2022.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: union-of-india-&-ors-vs-ms.-willowood-chemi-supreme-court-of-india-judgment-dated-19-04-2022.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Tax Refund Disputes

See all petitions in GST Law

See all petitions in Income Tax Disputes

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by S Ravindra Bhat

See all petitions in allowed

See all petitions in Modified

See all petitions in supreme court of India judgments April 2022

See all petitions in 2022 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category