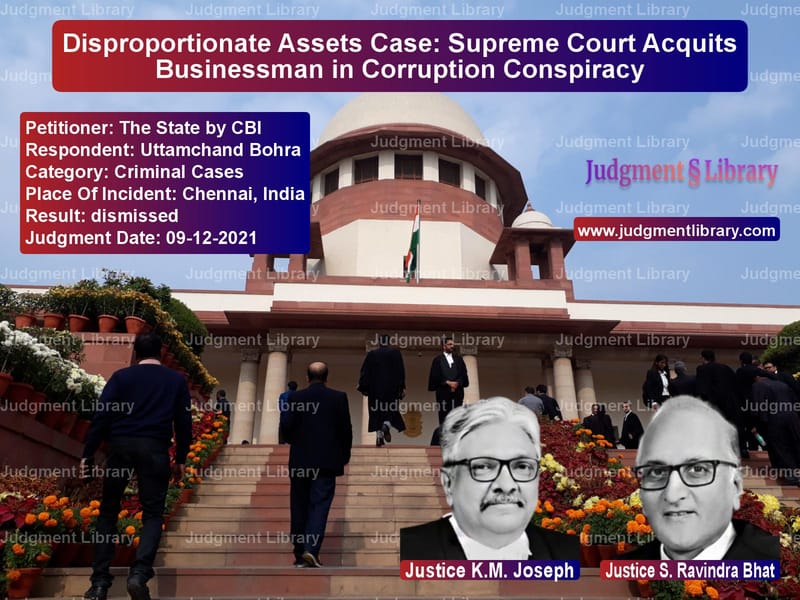

Disproportionate Assets Case: Supreme Court Acquits Businessman in Corruption Conspiracy

The Supreme Court recently ruled in the case of The State by CBI vs. Uttamchand Bohra, addressing allegations of corruption and conspiracy involving disproportionate assets. The case involved a senior income tax officer (A-1) accused of amassing wealth beyond his known sources of income and a businessman, Uttamchand Bohra, accused of aiding him in laundering funds. The Court upheld the High Court’s decision to discharge Uttamchand Bohra, ruling that the mere possession of a property sale deed did not establish criminal conspiracy.

Background of the Case

The Central Bureau of Investigation (CBI) filed a case against multiple accused, including a senior income tax officer (A-1), his wife (A-2), and businessman Uttamchand Bohra (A-5), alleging that A-1 had acquired assets worth ₹2.32 crore, which were disproportionate to his known sources of income. The prosecution claimed that these assets were laundered through various individuals and entities.

The trial court initially framed charges against all accused, including Uttamchand Bohra, under:

- Section 120B IPC – Criminal Conspiracy

- Section 109 IPC – Abetment

- Section 13(2) read with 13(1)(e) of the Prevention of Corruption Act (PCA), 1988

However, the High Court quashed the charges against Uttamchand Bohra, leading the CBI to appeal before the Supreme Court.

Petitioner’s (CBI) Arguments

The CBI, represented by the Additional Solicitor General, argued:

- Uttamchand Bohra was a financier closely associated with A-1 and helped him in acquiring property through indirect means.

- The sale deed of a property purchased in Chennai was seized from Uttamchand Bohra’s residence, suggesting his involvement in the transaction.

- The money trail revealed that the property was purchased using funds routed through multiple companies connected to A-1.

- Uttamchand’s employee had signed the sale deed as a witness, further proving his direct role in facilitating the transaction.

- The trial court had correctly framed charges, as there was sufficient evidence to create a “reasonable suspicion” of criminal conspiracy.

Respondent’s (Uttamchand Bohra) Arguments

The defense countered the prosecution’s claims, stating:

- Merely possessing the sale deed of a property does not amount to criminal conspiracy.

- He was a financier and had disclosed all financial dealings in his income tax records.

- The High Court had correctly observed that the prosecution failed to establish any link between him and the acquisition of disproportionate assets.

- The money trail connecting A-1’s corruption to the property purchase did not involve him.

- The prosecution was relying on suspicion rather than substantive evidence.

Supreme Court’s Observations

The Supreme Court evaluated the legal principles governing conspiracy and corruption cases and made the following key observations:

1. Mere Possession of Property Documents Does Not Prove Criminal Conspiracy

The Court held that merely holding a property document does not establish involvement in a conspiracy.

“Mere possession of the registered sale deed, which was witnessed by an employee of the respondent, cannot incriminate him.”

2. No Direct Link Between Uttamchand and the Corrupt Money Trail

The Court analyzed the prosecution’s money trail argument and found no evidence connecting Uttamchand to the funds used for the property purchase.

“There is no evidence that the respondent financed or facilitated the illicit purchase of assets by A-1.”

3. Suspicion Alone Cannot Be the Basis for Criminal Charges

The Court reiterated that criminal charges require a prima facie case based on evidence, not just suspicion.

“Strong suspicion is not enough to frame charges. The prosecution must establish a reasonable link between the accused and the alleged offense.”

4. No Role in the Acquisition of Disproportionate Assets

The Court noted that there was no evidence showing that Uttamchand abetted A-1 in acquiring wealth beyond his known income sources.

“There is no allegation that the respondent received monetary benefit or actively participated in laundering illicit funds.”

5. Legal Precedents on Discharge of Accused

The Court referred to previous judgments, emphasizing that courts must consider only the evidence in the charge sheet when deciding whether to frame charges.

“If the prosecution fails to produce material linking the accused to the offense, the court must discharge them.”

Supreme Court’s Verdict

Based on the lack of substantive evidence against Uttamchand Bohra, the Supreme Court:

- Dismissed the CBI’s appeal, upholding the High Court’s order.

- Ruled that no prima facie case of conspiracy or abetment was made out.

- Held that the mere possession of the sale deed did not prove involvement in corruption.

Implications of the Judgment

This ruling has significant implications for corruption and conspiracy cases:

- Higher Standards for Conspiracy Charges: Courts cannot rely solely on suspicion; evidence must establish a direct link between the accused and the alleged offense.

- Protection Against Arbitrary Prosecution: Businesspersons and financiers dealing with government officials cannot be prosecuted without clear proof of wrongdoing.

- Reinforcement of Legal Principles: The ruling affirms that possession of documents does not automatically implicate an individual in a conspiracy.

- Guidance for Law Enforcement: Investigative agencies must present tangible evidence rather than relying on assumptions and indirect associations.

The judgment reaffirms the principle that the criminal justice system must be based on evidence and not mere speculation.

Petitioner Name: The State by CBI.Respondent Name: Uttamchand Bohra.Judgment By: Justice K.M. Joseph, Justice S. Ravindra Bhat.Place Of Incident: Chennai, India.Judgment Date: 09-12-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: the-state-by-cbi-vs-uttamchand-bohra-supreme-court-of-india-judgment-dated-09-12-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Money Laundering Cases

See all petitions in Fraud and Forgery

See all petitions in Judgment by K.M. Joseph

See all petitions in Judgment by S Ravindra Bhat

See all petitions in dismissed

See all petitions in supreme court of India judgments December 2021

See all petitions in 2021 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category