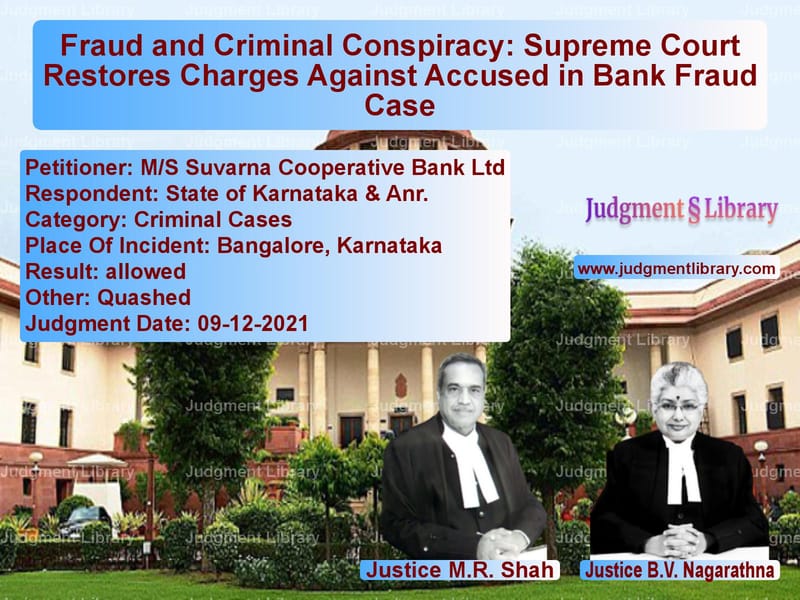

Fraud and Criminal Conspiracy: Supreme Court Restores Charges Against Accused in Bank Fraud Case

The Supreme Court of India recently ruled on an important case concerning bank fraud, criminal breach of trust, and cheating. The case, M/S Suvarna Cooperative Bank Ltd vs. State of Karnataka & Anr., involved allegations of financial fraud under Sections 120B, 408, 409, 420, and 149 of the Indian Penal Code (IPC). The Supreme Court set aside a Karnataka High Court ruling that had quashed criminal proceedings against one of the accused, reaffirming the principle that an incomplete charge sheet does not justify dismissing charges against an accused person.

Background of the Case

The case arose from a complaint filed by Suvarna Cooperative Bank Ltd, alleging that the accused individuals had committed fraud and breach of trust. The complainant bank filed a case under Section 200 of the Code of Criminal Procedure (Cr.P.C.), which led to the registration of an FIR (Crime No.127 of 2010) at the Chickpet Police Station. The charges included:

- Section 120B IPC – Criminal conspiracy

- Section 408 IPC – Criminal breach of trust by a clerk or servant

- Section 409 IPC – Criminal breach of trust by a banker, merchant, or agent

- Section 420 IPC – Cheating and dishonestly inducing delivery of property

- Section 149 IPC – Every member of an unlawful assembly guilty of an offense

The police conducted an investigation and filed a charge sheet against some of the accused, including the private respondent (original accused no.1).

High Court’s Verdict

The accused filed a petition before the Karnataka High Court under Section 482 Cr.P.C., seeking to quash the criminal proceedings against them. The High Court ruled in their favor, quashing the proceedings mainly on the following grounds:

- The charge sheet was incomplete because some individuals (accused nos. 2 and 3) were not named as accused.

- The charge sheet did not name officers of the drawee bank who allegedly failed to inform the payee’s banker of the cheque dishonor.

- Prosecuting only some of the accused without others being arraigned would not result in a complete trial.

The High Court, therefore, held that the case could not logically proceed without all alleged conspirators being prosecuted together and quashed the proceedings against accused no.1.

Supreme Court’s Observations

On appeal, the Supreme Court disagreed with the High Court’s reasoning and held that its judgment was legally and factually unsustainable. The Court made several important observations:

1. Quashing of Criminal Proceedings Based on Incomplete Charge Sheet is Not Justified

The Supreme Court found that the High Court had quashed the criminal proceedings on an incorrect assumption that the absence of some co-accused in the charge sheet made the case incomplete:

“Merely because some of the persons who might have committed the offenses are not charge-sheeted, cannot be a ground to quash the proceedings against the accused charge-sheeted after having found prima facie case against him after investigation.”

2. Investigation and Charge-Sheeting are Separate from Trial Process

The Court clarified that a charge sheet is based on the evidence available at the time of investigation, while a trial determines the guilt of an accused. If additional individuals were involved in the fraud, the prosecution could still bring them to trial under Section 319 Cr.P.C.:

“During the trial, if it is found that other accused persons who committed the offense are not charge-sheeted, the Court may array those persons as accused in exercise of powers under Section 319 Cr.P.C.”

3. The High Court Failed to Examine the Merits of the Allegations

The Supreme Court pointed out that the High Court quashed the case without analyzing whether the accused had committed the offenses. Instead, it dismissed the case merely because some co-accused were not named. The Supreme Court held:

“Nothing has been further observed by the High Court on merits and/or on the allegations against the private respondent herein – original accused no.1.”

4. Fraud and Criminal Breach of Trust Must Be Dealt With Stringently

The Court emphasized the importance of holding those involved in financial fraud accountable, particularly in the banking sector, where trust is paramount:

“Criminal breach of trust and fraud in financial institutions must be dealt with stringently. A person against whom a prima facie case is made cannot escape prosecution merely because all co-conspirators have not yet been charged.”

Supreme Court’s Verdict

After considering all legal aspects, the Supreme Court set aside the Karnataka High Court’s judgment and restored the criminal case against accused no.1. The Court ruled:

- The High Court’s decision to quash the proceedings was erroneous and legally unsound.

- The charge sheet against accused no.1 was valid and he must face trial.

- The case would proceed in accordance with law, and additional accused could be added if required.

The Supreme Court allowed the appeal and reinstated the criminal proceedings against accused no.1, directing that he be prosecuted for the charges mentioned in the charge sheet.

Implications of the Judgment

This ruling has significant implications for cases involving financial fraud and criminal conspiracy:

- Ensuring Accountability in Financial Crimes: The judgment reinforces that accused individuals cannot escape prosecution simply because all co-conspirators have not been charged yet.

- Preventing Premature Quashing of Cases: The ruling ensures that cases are not dismissed at the High Court level without a full trial if prima facie evidence exists.

- Strengthening Banking Regulations: The judgment upholds the necessity of stringent legal measures to prevent fraud in financial institutions.

- Clarification on Section 319 Cr.P.C.: The decision reaffirms that if new evidence emerges during trial, courts can summon additional accused under Section 319 Cr.P.C.

This decision by the Supreme Court sets a strong precedent for financial fraud cases, ensuring that those who engage in criminal conspiracy, cheating, and breach of trust are brought to justice.

Petitioner Name: M/S Suvarna Cooperative Bank Ltd.Respondent Name: State of Karnataka & Anr..Judgment By: Justice M.R. Shah, Justice B.V. Nagarathna.Place Of Incident: Bangalore, Karnataka.Judgment Date: 09-12-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-suvarna-cooperat-vs-state-of-karnataka-&-supreme-court-of-india-judgment-dated-09-12-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Fraud and Forgery

See all petitions in Money Laundering Cases

See all petitions in Banking Regulations

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by B.V. Nagarathna

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments December 2021

See all petitions in 2021 judgments

See all posts in Criminal Cases Category

See all allowed petitions in Criminal Cases Category

See all Dismissed petitions in Criminal Cases Category

See all partially allowed petitions in Criminal Cases Category