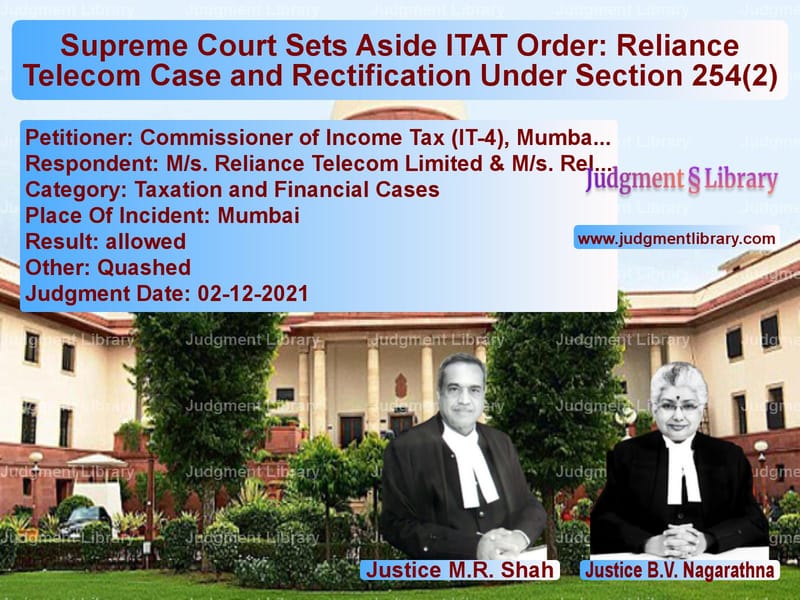

Supreme Court Sets Aside ITAT Order: Reliance Telecom Case and Rectification Under Section 254(2)

The Supreme Court of India recently ruled in the case of Commissioner of Income Tax (IT-4), Mumbai vs. M/s. Reliance Telecom Limited & M/s. Reliance Communications Limited. The case revolved around the power of the Income Tax Appellate Tribunal (ITAT) to recall its own orders under Section 254(2) of the Income Tax Act. The Supreme Court overturned the Bombay High Court’s ruling, holding that the ITAT had exceeded its jurisdiction by recalling an order under the guise of rectification.

Background of the Case

The dispute arose when the Commissioner of Income Tax (IT-4), Mumbai, challenged the decision of the ITAT, which had recalled its own order in favor of the revenue. The case was connected to tax treatment of payments made by Reliance Telecom Limited and Reliance Communications Limited to Ericsson A.B. for software licenses.

Key facts include:

- Reliance entered into a Supply Contract with Ericsson A.B. and sought an exemption from deducting TDS on payments made for software.

- The Assessing Officer (AO) ruled that the payments constituted royalty under Section 9(1)(vi) of the Income Tax Act and Article 12(3) of the India-Sweden Double Taxation Avoidance Agreement (DTAA).

- Reliance filed an appeal before the Commissioner of Income Tax (Appeals) (CIT(A)), which ruled in its favor, stating that the payment was not taxable in India.

- The revenue appealed to the ITAT, which in a detailed judgment dated September 6, 2013, ruled in favor of the revenue, stating that payments for software licenses amounted to royalty.

- Reliance challenged this ruling by filing a miscellaneous application under Section 254(2) of the Act before the ITAT for rectification of mistakes.

- The ITAT, on November 18, 2016, recalled its earlier order and ruled in favor of Reliance.

- Upon this favorable order, Reliance withdrew its pending appeal before the Bombay High Court.

- The revenue challenged the ITAT’s rectification order before the Bombay High Court, which upheld the ITAT’s decision.

The revenue, dissatisfied with the High Court’s ruling, appealed to the Supreme Court.

Legal Issues Raised

- Whether the ITAT had the power under Section 254(2) of the Income Tax Act to recall its own decision.

- Whether an order passed by the ITAT on merits could be revisited through a rectification petition.

- Whether the High Court erred in upholding the ITAT’s recall order.

Petitioner’s Arguments (Revenue)

- The revenue contended that Section 254(2) permits only rectification of apparent mistakes and does not allow for a full-fledged rehearing of the appeal.

- The ITAT, while allowing the rectification, revisited the merits of the case, which was beyond its jurisdiction.

- The original ITAT ruling dated September 6, 2013, was a well-reasoned and detailed order and should not have been set aside under a rectification petition.

- Reliance had already filed an appeal in the High Court but withdrew it after securing a favorable order from the ITAT.

- The High Court wrongly ruled that ITAT had the power to recall its order, disregarding the limited scope of Section 254(2).

Respondent’s Arguments (Reliance Telecom Limited)

- Reliance contended that the ITAT had correctly exercised its power under Section 254(2) as there was an apparent error in the original ruling.

- The rectification petition was filed because the ITAT had overlooked crucial judicial precedents.

- Reliance claimed that the High Court was correct in allowing the ITAT’s recall since errors in interpreting legal provisions can be rectified.

Supreme Court’s Verdict

The Supreme Court, in a bench comprising Justices M.R. Shah and B.V. Nagarathna, ruled in favor of the revenue, stating that the ITAT had exceeded its jurisdiction under Section 254(2). The Court observed:

“The powers under Section 254(2) of the Act are akin to Order XLVII Rule 1 CPC. While considering the application under Section 254(2), the Appellate Tribunal is not required to revisit its earlier order and go into details on merits.”

The Court further held:

“The order passed by the ITAT dated 18.11.2016 recalling its earlier order dated 06.09.2013 is beyond the scope and ambit of powers under Section 254(2).”

Key Findings of the Supreme Court

- The ITAT cannot revisit its own findings under the guise of rectification.

- If Reliance believed that the ITAT had made a legal error, its only remedy was an appeal before the High Court, not a rectification petition.

- By withdrawing its High Court appeal after securing a favorable order from the ITAT, Reliance engaged in procedural abuse.

- The ITAT’s order recalling its decision was unsustainable in law.

Final Order

- The Supreme Court set aside the High Court’s ruling and restored the ITAT’s original order dated September 6, 2013.

- It directed that if Reliance wishes to appeal, it may do so before the High Court within six weeks, and the High Court must hear it without a limitation objection.

Key Takeaways

- Scope of Section 254(2) is limited: The provision allows rectification of mistakes apparent from the record but does not permit a rehearing of the case.

- Judicial discipline is crucial: The ITAT cannot recall its own order merely because a party is dissatisfied.

- Legal remedy must follow proper channels: If an ITAT ruling is erroneous, the correct remedy is an appeal, not a rectification.

- Procedural abuse discouraged: Withdrawing an appeal after securing a favorable rectification order is an abuse of the judicial process.

This ruling reinforces the importance of procedural discipline and ensures that rectification provisions are not misused to circumvent appellate remedies.

Petitioner Name: Commissioner of Income Tax (IT-4), Mumbai.Respondent Name: M/s. Reliance Telecom Limited & M/s. Reliance Communications Limited.Judgment By: Justice M.R. Shah, Justice B.V. Nagarathna.Place Of Incident: Mumbai.Judgment Date: 02-12-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: commissioner-of-inco-vs-ms.-reliance-teleco-supreme-court-of-india-judgment-dated-02-12-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Customs and Excise

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by B.V. Nagarathna

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments December 2021

See all petitions in 2021 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category