Balance Sheet Entries and Debt Acknowledgment: Supreme Court Clarifies Limitation Act in Insolvency Cases

The Supreme Court of India recently delivered a landmark judgment in Asset Reconstruction Company (India) Limited vs. Bishal Jaiswal & Anr., clarifying the applicability of the Limitation Act, 1963, to insolvency proceedings under the Insolvency and Bankruptcy Code (IBC), 2016. This judgment addresses whether entries in the balance sheets of corporate debtors can amount to an acknowledgment of liability, thus extending the limitation period for initiating insolvency proceedings.

Background of the Case

The dispute arose when Corporate Power Ltd. (the corporate debtor) set up a thermal power project in Jharkhand and availed loan facilities from multiple lenders, including the State Bank of India (SBI). The account of the corporate debtor was classified as a Non-Performing Asset (NPA) on 31st July 2013. SBI, acting as the lenders’ agent, issued a loan-recall notice on 27th March 2015. Subsequently, some of the original lenders assigned their debts to Asset Reconstruction Company (India) Limited (ARCIL), which issued a notice under the SARFAESI Act on 20th June 2015 and later took possession of the project assets.

ARCIL then filed an application under Section 7 of the IBC before the National Company Law Tribunal (NCLT), Kolkata, seeking recovery of ₹5,997 crore. Since the application did not specify a date of default, ARCIL filed a supplementary affidavit in November 2019, relying on balance sheets of the corporate debtor as evidence of acknowledgment of debt.

The NCLT admitted the application, holding that the balance sheets signed before the expiry of three years from the default date constituted acknowledgment under Section 18 of the Limitation Act. However, the National Company Law Appellate Tribunal (NCLAT), following the majority view in V. Padmakumar v. Stressed Assets Stabilisation Fund, held that balance sheet entries do not constitute acknowledgment of debt for extending the limitation period. The matter was then brought before the Supreme Court.

Arguments by the Petitioner (ARCIL)

The petitioner’s counsel argued:

“The majority judgment of the Full Bench of the NCLAT in V. Padmakumar was per incuriam, as it failed to consider various binding precedents of the Supreme Court. The Court has repeatedly held that Section 18 of the Limitation Act applies to insolvency proceedings and that balance sheet entries acknowledging liabilities extend the limitation period.”

The petitioner further contended that the High Courts and Supreme Court have consistently ruled that an acknowledgment of liability in signed balance sheets constitutes a valid acknowledgment under Section 18 of the Limitation Act.

Arguments by the Respondents

The respondents countered:

“The Explanation to Section 7 of the IBC and the definition of ‘default’ under Section 3(12) preclude the application of Section 18 of the Limitation Act. A financial debt owed to multiple creditors cannot be revived merely by an acknowledgment in a balance sheet.”

The respondents also argued that the IBC is not a recovery mechanism and that claims barred by limitation cannot be resurrected under insolvency proceedings. They relied on the majority decision in V. Padmakumar and High Court judgments that rejected balance sheet acknowledgments as valid for extending limitation.

Supreme Court’s Observations

The Supreme Court considered various aspects, including the legislative intent behind Section 238A of the IBC, which applies the Limitation Act to IBC proceedings.

It observed:

“An acknowledgment of liability in a corporate debtor’s balance sheet extends the limitation period under Section 18 of the Limitation Act. The judgment in V. Padmakumar incorrectly ignored this principle and was erroneously decided.”

The Court referred to several precedents where entries in balance sheets had been held as valid acknowledgments of liability:

- Mahabir Cold Storage v. CIT (1991): The Court held that balance sheet entries acknowledging debt extended the limitation period.

- A.V. Murthy v. B.S. Nagabasavanna (2002): Acknowledgment in a balance sheet was deemed sufficient for extending limitation.

- Shahi Exports Pvt. Ltd. v. CMD Buildtech Pvt. Ltd. (2013): The Delhi High Court ruled that an entry in a balance sheet amounts to acknowledgment of liability.

The Supreme Court also emphasized that filing a balance sheet is mandatory under the Companies Act, 2013, but this does not mean that an acknowledgment made therein loses its voluntary nature.

Key Ruling by the Supreme Court

1. The Full Bench decision in V. Padmakumar was set aside.

2. The Supreme Court held that entries in a balance sheet acknowledging debt amount to an acknowledgment under Section 18 of the Limitation Act, thereby extending the limitation period.

3. The matter was remanded to the NCLAT to be decided in accordance with the Supreme Court’s ruling.

Implications of the Judgment

This decision has far-reaching consequences for insolvency law in India. It ensures that:

- Creditors can rely on balance sheet acknowledgments to extend limitation periods.

- Corporate debtors cannot escape liability by exploiting technicalities in limitation laws.

- The IBC remains an effective tool for resolving corporate insolvencies rather than being dismissed on limitation grounds.

Conclusion

The Supreme Court’s ruling in Asset Reconstruction Company (India) Ltd. v. Bishal Jaiswal provides much-needed clarity on the interplay between the Limitation Act and the IBC. It reinforces that financial creditors can rely on balance sheet acknowledgments to extend limitation periods, ensuring a fair and just approach to debt recovery within insolvency proceedings.

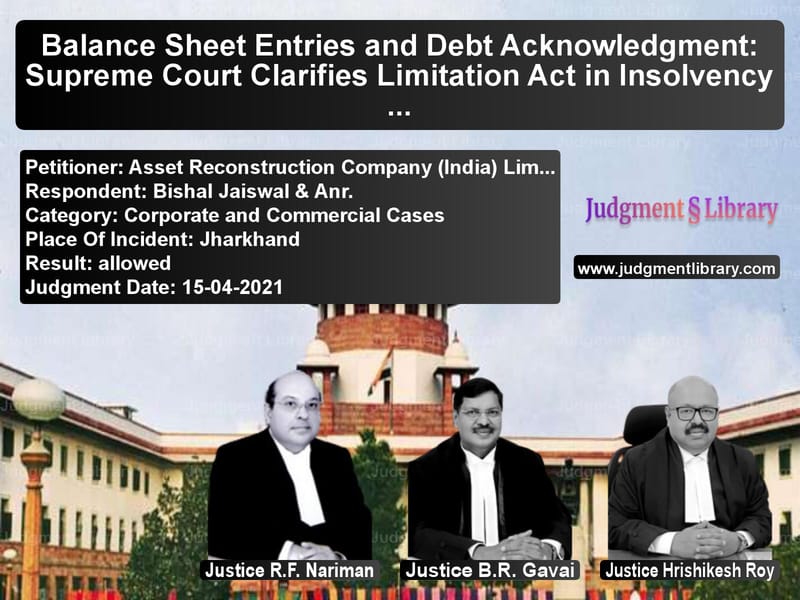

Petitioner Name: Asset Reconstruction Company (India) Limited.Respondent Name: Bishal Jaiswal & Anr..Judgment By: Justice R.F. Nariman, Justice B.R. Gavai, Justice Hrishikesh Roy.Place Of Incident: Jharkhand.Judgment Date: 15-04-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: asset-reconstruction-vs-bishal-jaiswal-&-anr-supreme-court-of-india-judgment-dated-15-04-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Bankruptcy and Insolvency

See all petitions in Corporate Compliance

See all petitions in Judgment by Rohinton Fali Nariman

See all petitions in Judgment by B R Gavai

See all petitions in Judgment by Hrishikesh Roy

See all petitions in allowed

See all petitions in supreme court of India judgments April 2021

See all petitions in 2021 judgments

See all posts in Corporate and Commercial Cases Category

See all allowed petitions in Corporate and Commercial Cases Category

See all Dismissed petitions in Corporate and Commercial Cases Category

See all partially allowed petitions in Corporate and Commercial Cases Category