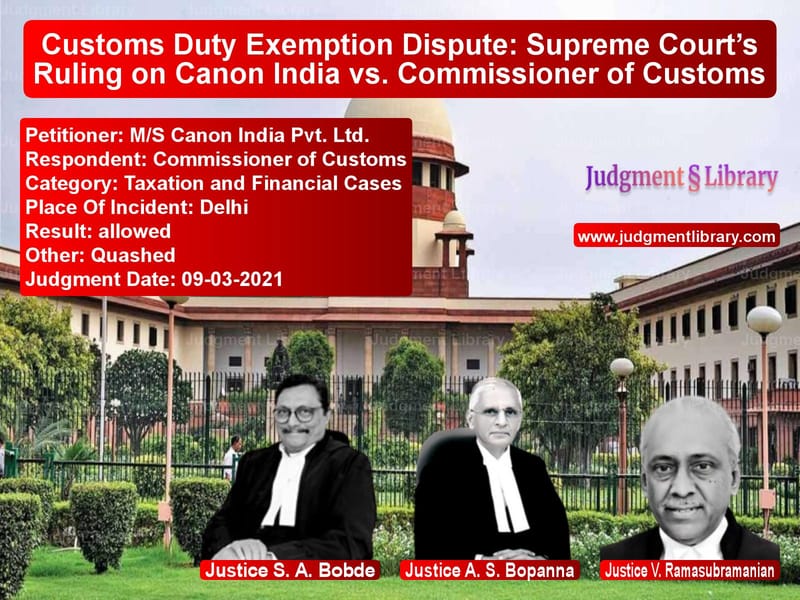

Customs Duty Exemption Dispute: Supreme Court’s Ruling on Canon India vs. Commissioner of Customs

The case of M/S Canon India Pvt. Ltd. vs. Commissioner of Customs revolves around the issue of customs duty exemption on imported cameras and whether the Directorate of Revenue Intelligence (DRI) had the authority to issue show cause notices under Section 28(4) of the Customs Act, 1962. The Supreme Court’s decision has set an important precedent on the scope of powers of revenue intelligence officers and the interpretation of customs law.

Background of the Case

The case originated from a dispute between Canon India and the customs authorities regarding the classification of digital still image video cameras (DSIC) for the purpose of customs duty exemption. Canon India and other companies, including Nikon India, Sony India, and Samsung India, imported cameras and claimed exemption under Notification No. 15/2012, which allowed certain types of digital cameras to be imported duty-free.

The customs authorities initially cleared the cameras without levying duty. However, the Directorate of Revenue Intelligence (DRI) later issued a show cause notice under Section 28(4) of the Customs Act, alleging that the cameras did not qualify for the exemption and that duty had been evaded by misrepresenting the product’s specifications.

Key Issues Before the Court

The Supreme Court considered the following key issues:

- Whether the Directorate of Revenue Intelligence (DRI) had the legal authority to issue a show cause notice for recovery of duties under Section 28(4) of the Customs Act.

- Whether the cameras in question met the criteria for customs duty exemption.

- Whether the extended limitation period for recovering duty under Section 28(4) was applicable in this case.

Arguments of the Parties

Petitioner’s Arguments (Canon India and Other Importers):

- The show cause notice was issued by the DRI and not by the officer who initially cleared the goods, violating the legal framework.

- Section 28(4) confers power only on “the proper officer” who assessed the goods, and the DRI officer did not qualify as such.

- The cameras were correctly classified under the exemption notification, as they met the specified technical criteria.

- The extended limitation period for recovery was not applicable as there was no willful misrepresentation or suppression of facts.

The Supreme Court took note of Canon India’s argument: “Parliament has employed the article ‘the’ not accidentally but with the intention to designate the proper officer who had assessed the goods at the time of clearance.”

Respondent’s Arguments (Commissioner of Customs and DRI):

- The exemption was wrongly claimed, as the cameras could record multiple sequences of videos exceeding 30 minutes, violating the exemption conditions.

- The DRI had jurisdiction to issue the show cause notice under Section 28(4) for recovery of unpaid duty.

- There was suppression of facts, justifying the extended limitation period for issuing the show cause notice.

Supreme Court’s Ruling

1. DRI’s Lack of Authority to Issue Show Cause Notices

The Court held that the DRI officer was not the “proper officer” under Section 28(4) of the Customs Act. It ruled:

- “When the statute directs that ‘the proper officer’ can determine duty not levied or not paid, it does not mean any proper officer but that proper officer alone.”

- The officer who originally assessed and cleared the goods was the only officer authorized to issue a notice for recovery.

- The DRI’s show cause notice was thus without jurisdiction and liable to be quashed.

2. Exemption Qualification for the Imported Cameras

The Supreme Court did not find it necessary to examine whether the cameras qualified for the exemption. However, it noted that similar cameras had been granted exemption both before and after the contested period.

3. Limitation Period and Allegations of Misrepresentation

The Court rejected the claim that Canon India had misrepresented facts. It held that:

- The importers had disclosed the full specifications of the cameras to the customs authorities at the time of clearance.

- The customs officers had verified the goods before approving the exemption.

- Since there was no deliberate suppression of facts, the extended limitation period under Section 28(4) did not apply.

Final Judgment

The Supreme Court set aside the CESTAT’s order and quashed the show cause notices issued by the DRI. The ruling made the following key determinations:

- Only the officer who originally assessed and cleared the goods has the authority to issue recovery notices under Section 28(4).

- DRI officers do not have independent authority to reopen assessments and issue notices for duty recovery.

- Importers cannot be accused of misrepresentation if they provided full disclosure and the customs authorities made an informed decision.

- The extended limitation period for recovery cannot be applied in the absence of deliberate fraud or suppression of facts.

The ruling is significant as it curtails the powers of the DRI in reopening customs assessments and reinforces the principle that legal procedures must be strictly followed in tax and duty matters.

Petitioner Name: M/S Canon India Pvt. Ltd..Respondent Name: Commissioner of Customs.Judgment By: Justice S. A. Bobde, Justice A. S. Bopanna, Justice V. Ramasubramanian.Place Of Incident: Delhi.Judgment Date: 09-03-2021.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: ms-canon-india-pvt.-vs-commissioner-of-cust-supreme-court-of-india-judgment-dated-09-03-2021.pdf

Directly Download Judgment: Directly download this Judgment

See all petitions in Customs and Excise

See all petitions in Tax Refund Disputes

See all petitions in Banking Regulations

See all petitions in Income Tax Disputes

See all petitions in Judgment by S. A. Bobde

See all petitions in Judgment by A. S. Bopanna

See all petitions in Judgment by V. Ramasubramanian

See all petitions in allowed

See all petitions in Quashed

See all petitions in supreme court of India judgments March 2021

See all petitions in 2021 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category