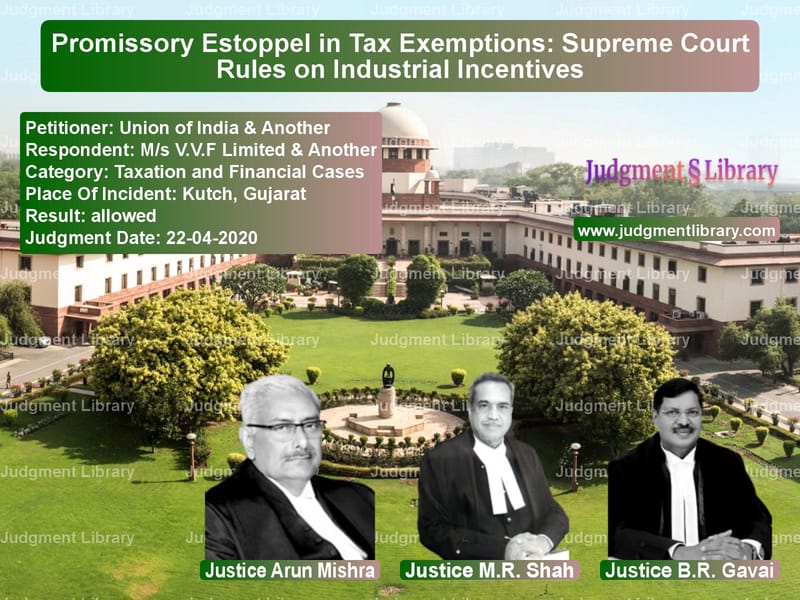

Promissory Estoppel in Tax Exemptions: Supreme Court Rules on Industrial Incentives

The case of Union of India & Another vs. M/s V.V.F Limited & Another concerned the withdrawal of an industrial incentive scheme providing tax exemptions to industries in the Kutch district following the 2001 Gujarat earthquake. The Supreme Court had to determine whether the government’s decision to amend the exemption policy was a violation of the doctrine of promissory estoppel and whether industries could claim continued benefits despite the policy change. The Court ultimately upheld the withdrawal of incentives, ruling that promissory estoppel cannot override public interest.

Background of the Case

The case originated from the Central Excise Exemption Notification No. 39/2001-CE dated 31.07.2001, which was introduced to encourage industrial development in the earthquake-affected Kutch district of Gujarat. The notification granted exemptions from excise duty for new industrial units that commenced commercial production before 31.07.2003 (later extended to 31.12.2005). The exemption was for a period of five years from the start of production.

Several companies, including M/s V.V.F Limited, established manufacturing units in Kutch based on this incentive. However, in 2008, the government introduced Notification No. 16/2008-CE, which modified the exemption scheme by linking refunds to value addition instead of granting a full refund on duty paid in cash. This significantly reduced the benefits available to the industries.

Industries challenged this amendment, arguing that it was retrospective and violated the doctrine of promissory estoppel. The Gujarat High Court ruled in favor of the industries, striking down the 2008 amendment. The Union of India appealed this decision before the Supreme Court.

Key Legal Issues

- Whether the withdrawal or modification of the tax exemption violated the doctrine of promissory estoppel.

- Whether the amendment was retrospective and thereby took away vested rights of the beneficiaries.

- Whether the government had the authority to alter or rescind an incentive scheme in the public interest.

Petitioner’s Arguments (Union of India)

- The government argued that the exemption was being misused by certain manufacturers engaging in tax evasion tactics.

- The change in policy was made in the public interest to prevent revenue leakage and ensure only genuine manufacturers benefited from the scheme.

- The amendment was clarificatory in nature and did not take away any vested rights.

- Promissory estoppel cannot be used to bind the government to a policy that is detrimental to public finances.

Respondent’s Arguments (M/s V.V.F Limited & Others)

- The companies argued that they had made significant investments in Kutch based on the promise of full tax exemption.

- They claimed that the amendment was retrospective in effect and unfairly reduced their benefits midway.

- The original notification created a legitimate expectation, and the government was estopped from withdrawing the incentives before the promised period expired.

- They cited precedents where courts had upheld industrial incentives as binding commitments.

Supreme Court’s Observations

The Supreme Court analyzed the doctrine of promissory estoppel in the context of fiscal policies:

- While promissory estoppel applies to government policies, it cannot prevent the government from modifying schemes in the larger public interest.

- Exemption notifications under fiscal laws are subject to change based on economic realities and revenue considerations.

- The government has the power to modify exemptions if it finds that the scheme is being misused.

- Industries that had already received refunds before the 2008 notification were not required to repay them, but pending refund applications had to be decided based on the new scheme.

The Court stated, “The withdrawal of exemption in public interest is a matter of policy, and courts should not interfere with fiscal decisions unless there is proven malice or arbitrariness.”

Final Judgment

The Supreme Court ruled in favor of the government:

- The doctrine of promissory estoppel does not override public interest considerations.

- The 2008 amendment was valid and applicable prospectively.

- Industries must comply with the revised incentive structure, linking refunds to value addition.

Implications of the Judgment

The ruling has significant implications for industrial policies and tax laws:

- Governments retain the authority to modify tax incentives to address misuse and revenue concerns.

- Businesses must account for the possibility of policy changes when making investment decisions.

- The judgment clarifies that fiscal policies are subject to periodic review and cannot be claimed as permanent rights.

This judgment reinforces the principle that tax exemptions and incentives are privileges, not absolute rights, and can be altered in the public interest.

Petitioner Name: Union of India & Another.Respondent Name: M/s V.V.F Limited & Another.Judgment By: Justice Arun Mishra, Justice M.R. Shah, Justice B.R. Gavai.Place Of Incident: Kutch, Gujarat.Judgment Date: 22-04-2020.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Union of India & Ano vs Ms V.V.F Limited & Supreme Court of India Judgment Dated 22-04-2020.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in Tax Evasion Cases

See all petitions in Banking Regulations

See all petitions in Judgment by Arun Mishra

See all petitions in Judgment by Mukeshkumar Rasikbhai Shah

See all petitions in Judgment by B R Gavai

See all petitions in allowed

See all petitions in supreme court of India judgments April 2020

See all petitions in 2020 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category