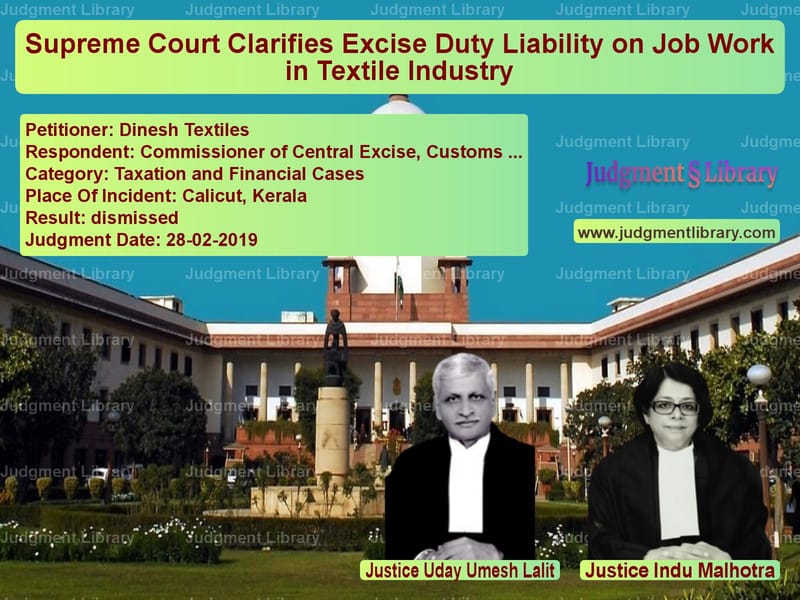

Supreme Court Clarifies Excise Duty Liability on Job Work in Textile Industry

The case of Dinesh Textiles vs. Commissioner of Central Excise, Customs and Service Tax, Calicut deals with excise duty liability on job work in the textile industry. The Supreme Court was tasked with determining whether traders who get textile goods manufactured by job workers are liable for excise duty under Rule 12B of the Central Excise Rules, 2002.

Background of the Case

The appellant, Dinesh Textiles, is a trader that gets cotton fabrics and textile articles manufactured through job workers. The case originated when the Central Excise Department issued show cause notices to Dinesh Textiles, demanding excise duty on the clearances of goods made through job workers.

Key facts:

- Rule 12B was inserted into the Central Excise Rules, 2002, on March 25, 2003, making traders liable for excise duty on goods manufactured on their behalf.

- Exemption notifications were issued, providing duty relief up to Rs. 20 lakhs in financial year 2003-04 for small manufacturers.

- Dinesh Textiles had engaged over 70 job workers and had total clearances of over Rs. 1.45 crore.

- Only one job worker, Dinesh Weaving Mills, had clearances exceeding Rs. 25 lakhs.

- The Central Excise Department claimed that the trader was liable for excise duty on the aggregate value of all clearances, not just those exceeding Rs. 25 lakhs.

Legal Issues

The case raised the following legal questions:

- Whether traders who engage job workers for textile production are liable for excise duty.

- Whether excise duty liability applies only to job workers exceeding the exemption limit or to the trader’s entire aggregate clearances.

- Whether the exemption notification and subsequent clarifications correctly applied to the appellant’s case.

Petitioner’s Arguments

Dinesh Textiles argued:

- The primary excise duty liability rests with the job workers, not the traders.

- As per the exemption notification, only individual job workers exceeding the Rs. 25 lakh limit should be liable.

- They merely supplied raw materials and did not carry out manufacturing themselves.

- The Central Excise Department misinterpreted Rule 12B and the exemption notifications.

- The Tribunal ignored key clarifications that provided relief to traders.

Respondent’s Arguments

The Central Excise Department countered:

- Rule 12B expressly makes traders liable for excise duty if they get textiles manufactured through job work.

- The exemption notification applies to the first Rs. 20 lakhs of clearances, but once the limit is crossed, duty applies to the entire aggregate value.

- The circular dated October 30, 2003, clarified that if any job worker exceeded Rs. 25 lakhs in clearances, the trader would be liable for duty on all their job workers’ clearances.

- The appellate authority and the Tribunal correctly held the trader liable.

Supreme Court’s Observations

The Supreme Court, led by Justice Uday Umesh Lalit and Justice Indu Malhotra, analyzed the legal framework under Rule 12B and the exemption notifications.

“The emphasis in the exemption notification is on the aggregate value of clearances, not individual clearances. The legal fiction under Rule 12B treats the trader as the manufacturer, making them liable for excise duty.”

The Court noted:

- The notification and Rule 12B do not permit traders to avoid liability by splitting production across multiple job workers.

- The exemption applies only to the first Rs. 20 lakhs of clearances.

- The Central Excise Department’s interpretation was consistent with the legislative intent.

- The Tribunal correctly applied the law in holding the appellant liable.

Final Judgment

The Supreme Court ruled:

- The appeal was dismissed.

- Dinesh Textiles was held liable for excise duty on all job work clearances.

- The Tribunal’s decision was upheld, affirming the excise duty demand.

Conclusion

This judgment clarifies that traders who engage job workers for textile production cannot escape excise duty liability. The ruling ensures compliance with Rule 12B and prevents traders from exploiting exemptions intended for small manufacturers. By reinforcing the aggregate clearance principle, the Supreme Court upheld the intent of excise duty laws and closed potential loopholes in tax compliance.

Petitioner Name: Dinesh Textiles.Respondent Name: Commissioner of Central Excise, Customs and Service Tax, Calicut.Judgment By: Justice Uday Umesh Lalit, Justice Indu Malhotra.Place Of Incident: Calicut, Kerala.Judgment Date: 28-02-2019.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: Dinesh Textiles vs Commissioner of Cent Supreme Court of India Judgment Dated 28-02-2019.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Customs and Excise

See all petitions in Tax Refund Disputes

See all petitions in Judgment by Uday Umesh Lalit

See all petitions in Judgment by Indu Malhotra

See all petitions in dismissed

See all petitions in supreme court of India judgments February 2019

See all petitions in 2019 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category