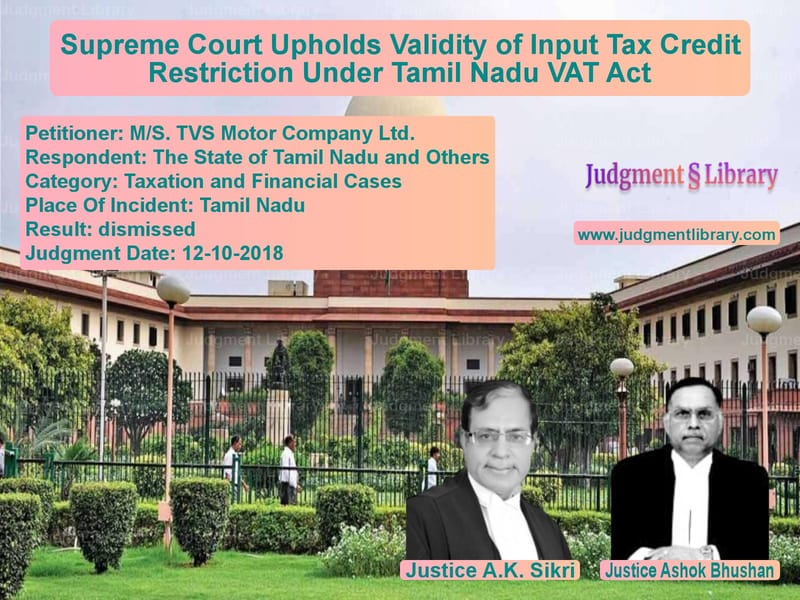

Supreme Court Upholds Validity of Input Tax Credit Restriction Under Tamil Nadu VAT Act

The Supreme Court of India, in its detailed judgment in M/S. TVS Motor Company Ltd. vs. The State of Tamil Nadu and Others, delivered on October 12, 2018, examined the legality of restricting Input Tax Credit (ITC) under the Tamil Nadu Value Added Tax Act, 2006 (TNVAT Act). The decision resolved a significant question regarding tax credit claims on inter-state sales and the constitutional validity of Section 19(5)(c) of the TNVAT Act.

Background of the Case

TVS Motor Company Ltd. (the petitioner), a major automobile manufacturer, challenged the provisions of Section 19(5)(c) of the TNVAT Act, which denied ITC on purchases made within the state when the goods were sold in inter-state trade without producing Form C. The provision mandated that ITC was only available if sales were made to registered dealers under the Central Sales Tax Act, 1956 (CST Act) and were supported by Form C.

The petitioner contended that this restriction violated the fundamental principles of VAT, which aims to prevent the cascading effect of taxes. According to the petitioner, the Tamil Nadu government had made commitments before the Empowered Committee of Finance Ministers that ITC would be uniformly available for all sales, including inter-state transactions.

Arguments by the Petitioner (TVS Motor Company Ltd.)

The petitioner argued that the restriction under Section 19(5)(c):

- Violated Articles 14, 19(1)(g), and 301 of the Constitution by treating sales made to registered and unregistered dealers differently.

- Contradicted the White Paper on VAT (2005), which promised seamless credit across all sales, including inter-state transactions.

- Adversely impacted businesses engaging in inter-state sales by increasing tax liability.

- Effectively penalized dealers who made genuine inter-state sales by denying ITC.

- Encouraged artificial structuring of transactions to circumvent the ITC restriction, leading to distortions in trade.

Arguments by the Respondents (State of Tamil Nadu and Others)

The Tamil Nadu government defended the provision by stating:

- The restriction on ITC was aimed at preventing tax evasion by ensuring that inter-state sales were made only to genuine registered dealers.

- ITC is a concession, not a right, and the legislature is competent to impose conditions for its availment.

- The provision was in line with the overall framework of VAT and was intended to maintain revenue neutrality.

- The condition that Form C must be produced for inter-state sales was necessary to ensure proper tax compliance.

High Court’s Judgment

The Madras High Court upheld the constitutional validity of Section 19(5)(c), ruling that:

- The condition imposed was a reasonable restriction and did not violate fundamental rights.

- ITC is a benefit granted by the state legislature and can be subject to conditions.

- The differentiation between sales to registered and unregistered dealers had a rational basis and was not arbitrary.

Supreme Court’s Analysis and Judgment

The Supreme Court examined whether Section 19(5)(c) and its accompanying rule under the TNVAT Rules violated constitutional provisions and the fundamental principles of VAT.

Key Observations of the Court

- The Court reiterated that ITC is not an inherent right but a concession extended by the legislature.

- The distinction between sales to registered and unregistered dealers was found to be reasonable and not arbitrary.

- Since the VAT regime was structured to ensure tax compliance, requiring Form C for inter-state sales was a legitimate policy measure.

- The Court dismissed the argument that the provision violated Article 301, stating that trade restrictions imposed for regulatory compliance do not necessarily violate free trade principles.

- However, the Court made an exception for sales to government departments of other states, ruling that state governments should be treated as registered dealers for ITC purposes.

Final Ruling

- The Supreme Court dismissed the petition and upheld the High Court’s ruling that Section 19(5)(c) was constitutionally valid.

- It clarified that businesses engaged in inter-state sales without Form C cannot claim ITC.

- The Court directed that sales made to other state governments should qualify for ITC even without Form C, provided the seller furnishes a certificate from the purchasing state government.

Impact of the Judgment

The ruling has significant implications for businesses engaged in inter-state trade:

- It reaffirms that ITC is a conditional concession that the state legislature can regulate.

- Businesses making inter-state sales must ensure compliance with Form C requirements to claim ITC.

- The judgment prevents potential revenue losses due to tax evasion by ensuring that inter-state sales are properly documented.

Conclusion

The Supreme Court’s judgment in M/S. TVS Motor Company Ltd. vs. The State of Tamil Nadu clarifies the scope of ITC in the context of inter-state sales. While upholding the restriction imposed under Section 19(5)(c), the Court provided an exception for sales to state governments, ensuring that legitimate transactions are not unfairly burdened. This ruling reinforces the principle that ITC is a statutory benefit subject to reasonable legislative conditions.

Petitioner Name: M/S. TVS Motor Company Ltd..Respondent Name: The State of Tamil Nadu and Others.Judgment By: Justice A.K. Sikri, Justice Ashok Bhushan.Place Of Incident: Tamil Nadu.Judgment Date: 12-10-2018.

Don’t miss out on the full details! Download the complete judgment in PDF format below and gain valuable insights instantly!

Download Judgment: MS. TVS Motor Compa vs The State of Tamil N Supreme Court of India Judgment Dated 12-10-2018.pdf

Direct Downlaod Judgment: Direct downlaod this Judgment

See all petitions in Income Tax Disputes

See all petitions in GST Law

See all petitions in Tax Evasion Cases

See all petitions in Judgment by A.K. Sikri

See all petitions in Judgment by Ashok Bhushan

See all petitions in dismissed

See all petitions in supreme court of India judgments October 2018

See all petitions in 2018 judgments

See all posts in Taxation and Financial Cases Category

See all allowed petitions in Taxation and Financial Cases Category

See all Dismissed petitions in Taxation and Financial Cases Category

See all partially allowed petitions in Taxation and Financial Cases Category